Hearsay’s Chief Marketing and Strategy Officer, Leslie Leach, joined Compliance Principal, Bill Simspon, to dive into the key findings of our second annual Compliance Benchmark Report. Below, we’ll share soundbites from the webinar that explain relationships between what’s happening in the industry and significant takeaways from this year’s compliance survey.

2022 Compliance Benchmark Report data collection methodology

- 23 questions about policies, procedures, priorities, planning, and budget

- Participants included 50 finserv professionals across all lines of business

>> Download the 2022 Compliance Benchmark Report

>> Watch the 2022 Compliance Benchmark Report Webinar replay

Introduction: 2022 has been a pivotal year for compliance

Regulatory pressure has reached a fever pitch for financial firms. As Bill explained during the webinar, “The SEC and other regulators are making it abundantly clear that being lax in supervision is no longer just ‘a cost of doing business.’ This major attitude shift has materialized in the form of more than $2 billion in fines being issued to financial institutions of all shapes and sizes.” So how are firms responding?

Digging into data: top financial firm challenges and priorities

In spite of regulatory scrutiny escalating to unprecedented levels in 2022, our data reveals that 58% of the firms surveyed have no plans to grow internal or external digital communication compliance team headcount over the next 12 months. Meaning—these firms will have to do more work with the same resources.

The same data shows that nearly half of all firms surveyed are feeling the pressure of increased regulatory action. This is evidenced by the fact that there are no reported plans to downsize compliance teams in the next 12 months, a notable pivot from the nearly 17% of firms that planned to reduce staff at the same time last year. Instead, 42% of survey respondents plan to hire staff this year—increasing their overall investment in compliance resources.

Which communication channels are most concerning to firms?

We asked respondents to rank channels in two categories; the top three channels with the highest reputational risk and the top three channels with the highest regulatory risk.

From a reputational risk standpoint, firms are nervous about the three T’s: TikTok, texting, and Twitter. On the regulatory side, texting, WhatsApp, and Facebook top the ‘risky’ list. What’s driving these rankings?

Reputation-wise, firms are most nervous about how to effectively apply policy to TikTok videos, text messages, and Twitter posts. It’s impossible to control everything every employee says, and social brings a new layer of anxiety. We’ve all seen it happen. One rogue Tweet taken out of context can snowball and get you ‘canceled.’ Potential reputational ramifications of social gone wrong present a big risk for firms that build their business on a foundation of trust.

From a regulatory standpoint, supervision teams are anxious to prevent errant communication. And not surprisingly, compliance teams are struggling to find the time to sift through endless streams of Facebook posts, comments, and messages; and text and WhatsApp messages exchanged between agents, advisors, prospects, and clients.

Tackling text compliance: where we stand today

Texting is the only channel to break into the top three of both risk categories. Why? Usage is widespread and is only increasing. The fact that texting most often takes place on personal devices also complicates supervision. So how are firms managing text compliance?

Leslie ran a live group poll during the webinar to find out. The results revealed that 33% of respondents work at firms with a no-texting policy, 17% plan to allow texting within the next year, and 50% currently allow texting.

Our take? Bill says, “The pervasiveness of texting has rendered ‘no texting’ policies ineffective. Firms willing to accept that texting is here to stay are focusing on building policies and procedures to support that position, and those firms are on the right track.”

What about WhatsApp, WeChat, and TikTok?

The most important question firms need to ask before making new digital channels available to agents and advisors is, can they be appropriately supervised? Right now, the answer to that question in relation to WhatsApp, WeChat, and TikTok is a resounding no. Why?

High-risk channels like the three listed above have immature APIs that don’t support effective supervision. Bill explains, “Without getting too technical, an API is an interface that’s used to integrate a platform into third-party tools. Many newer digital channels have APIs that aren’t robust enough to support supervisory processes that meet regulatory guidelines.”

Unfortunately, that’s not stopping companies from promising protection against regulatory action. However, it’s important for firms to know existing solutions either only offer partial protection or are violating these channels’ terms of service (e.g., by “screen-scraping) to provide makeshift supervisory tools.

Hearsay continuously evaluates popular social and messaging tools to determine viability for financial services professionals. One or more of these platforms will likely evolve to a point where it can be appropriately regulated, but it’s not going to happen overnight. For now, we encourage firms to stick to using fully vetted tools (Facebook, Twitter, LinkedIn, Instagram, texting) supported by proven compliance solutions.

How firms are responding to ever-growing compliance responsibilities

With limited time and resources at their disposal, most firms rely on a combination of delegation and automation to help manage compliance, as seen below:

How is this being managed? More and more firms are adopting proven finserv compliance technology and are using it to minimize regulatory risk and lessen operational burdens. These tech tools incorporate AI-enhanced review workflows, eliminating the need to review every individual text or social post, like, message, and comment.

For example, Hearsay Relate and Hearsay Social use artificial intelligence to review content, check it against a robust custom lexicon, and automatically send potentially offending content to compliance for feedback or approval. This process allows firms to proactively address potential issues, reducing the risk of non-compliant content making it out into the world. So now for the big question: Do firms find the pre-approval process valuable?

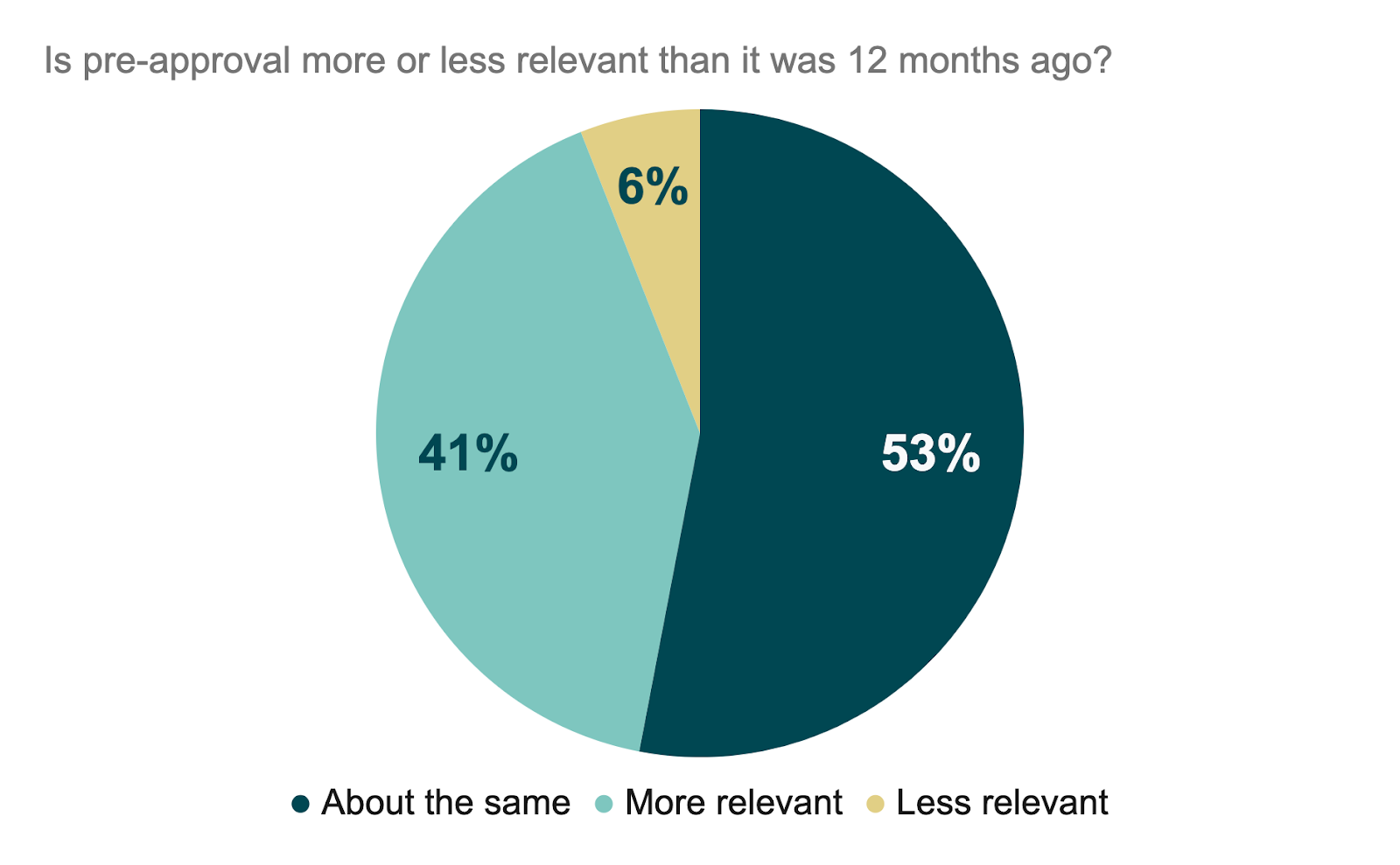

41% of firms report seeing more value today than they did last year in moving from a reactive ‘post-publish’ compliance process to a proactive ‘pre-approval’ process. This can be done by taking advantage of technology that supports sophisticated risk-based content analysis.

Automated workflows that simplify compliance at scale offer agents and advisors access to more digital communication channels, a capability that serves as a powerful recruiting and retention tool for firms.

Policy writing rises as a challenge for firms

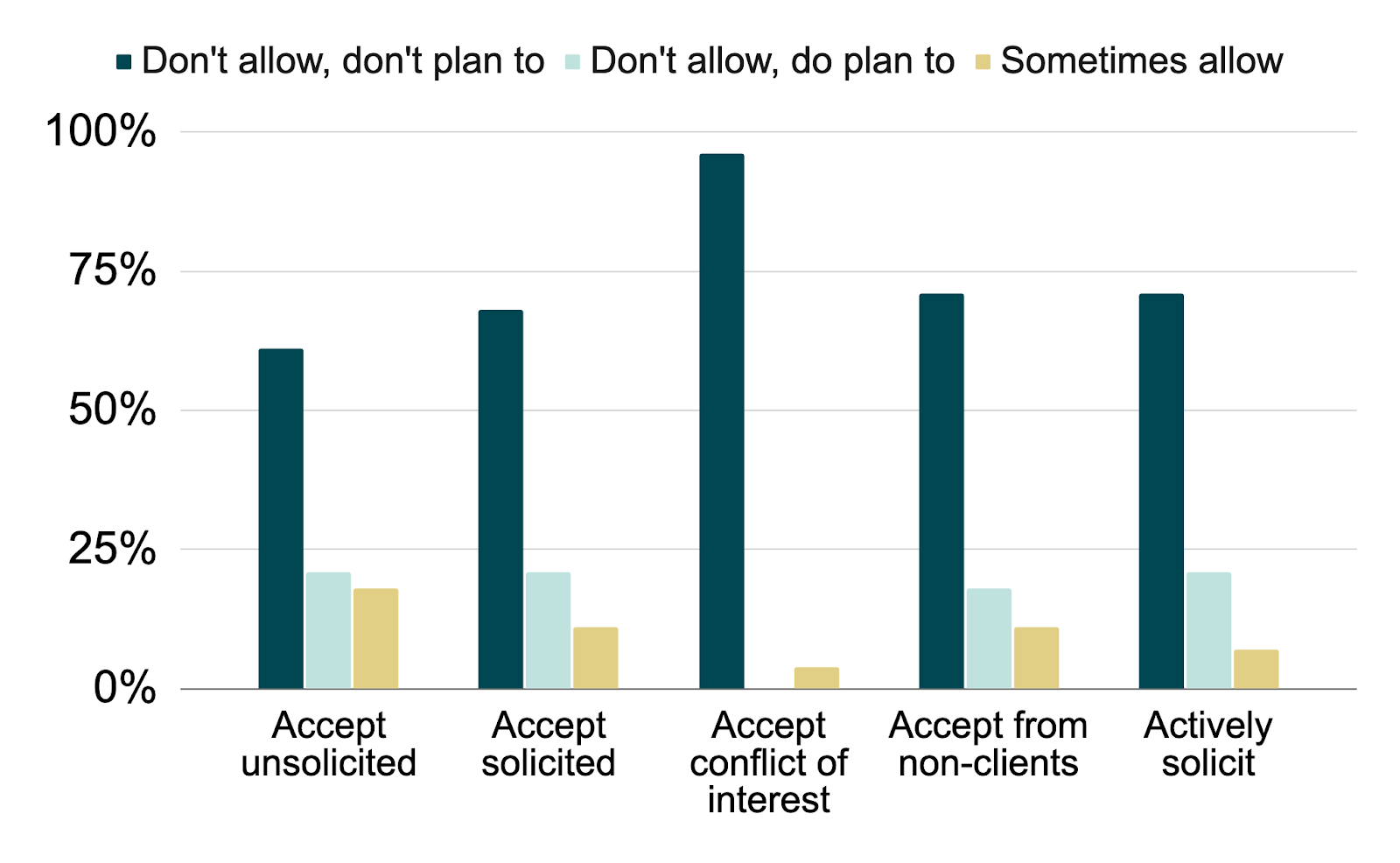

Firms have spent more time prioritizing procedure and policy writing this year. A real-time webinar poll on endorsements and testimonials, which were disallowed prior to the SEC’s Modernized Marketing Rule going into effect, showed this issue in action. Leslie asked the audience about their current testimonial and endorsement policy.

Here’s the result:

- 58% prohibit testimonials and endorsements

- 5% allow testimonials and endorsements with few limitations

- 37% allow testimonials and endorsements with many limitations

To compare, here are the compliance report results:

Both data sets show that firms are risk-averse when it comes to using testimonials and endorsements and opting to prohibit them altogether is a common sentiment. Why? Their use requires operational legwork in the form of policy development. But, when testimonials are prohibited, agents and advisors can’t use them to bolster their personal brand.

Leslie says, “This is painful for advisors, especially since 72% of consumers look up testimonials before making a purchasing decision.” Bill commented that he scrolls through reviews, even if he’s making a commitment as small as buying toothpaste on Amazon.

Now, imagine the impact missing testimonials have on making a decision like hiring someone to help manage your wealth and legacy. Hearsay Social provides vetting solutions for endorsements and testimonials, making it possible for firms to unlock this valuable marketing resource for their teams.

What’s the path to compliance success in 2023?

Keeping up with ever-increasing regulatory burdens requires firms to think outside the box. This year, firms plan to increase headcount, delegate supervision, take advantage of automated workflows, and improve reporting to manage compliance as we head into 2023. Some teams are also leaning on AI-powered and pre-approval processes to alleviate supervisory burdens.

If you’re struggling to find the bandwidth to manage compliance, 2023 may be the year to explore tech-powered solutions. Making the pivot from reactive to proactive compliance can markedly improve your business success while protecting your firm from regulatory action.